Burn Vault Mechanics

The Burn Vault is the cornerstone of the EVA Protocol, designed to ensure value stability and appreciation for EVA holders. This section explains the mechanics behind the Burn Vault and its critical role in creating a sustainable and deflationary token economy.

How the Burn Vault Works

The Burn Vault is an immutable smart contract that:

Stores Bitcoin Revenue:

Daily mining operations generate consistent Bitcoin revenue (currently around +17 BTC are transfered to the vault every month).

This BTC is converted into wrapped Bitcoin (wBTC) and deposited into the Burn Vault.

Provides a Minimum Value Guarantee:

- The Burn Vault holds wBTC reserves that establish a minimum price floor for EVA tokens.

- Each EVA token is guaranteed a proportional share of the vault's holdings, ensuring its value in Bitcoin can never fall below this baseline.

Deflationary Tokenomics:

- When users redeem EVA tokens, those tokens are permanently burned, reducing the total supply.

- While the Burn Price remains stable at the moment of burning, future wBTC mining rewards are distributed among fewer tokens, accelerating the growth of the token's value over time.

Key Metrics

| Metric | Value |

|---|---|

| Max EVA supply | 21,000,000 |

| Current EVA supply | 19,955,868 check |

| Current wBTC reserves | +130 BTC check |

| Daily BTC yield | ≈ 0.3035 BTC check |

| Burn Price Formula | (wBTC balance of BurnVault) / (EVA total supply) |

Note: Some values are taken at the moment of edition and may have changed, it's always posible to check the updated information by the links provided

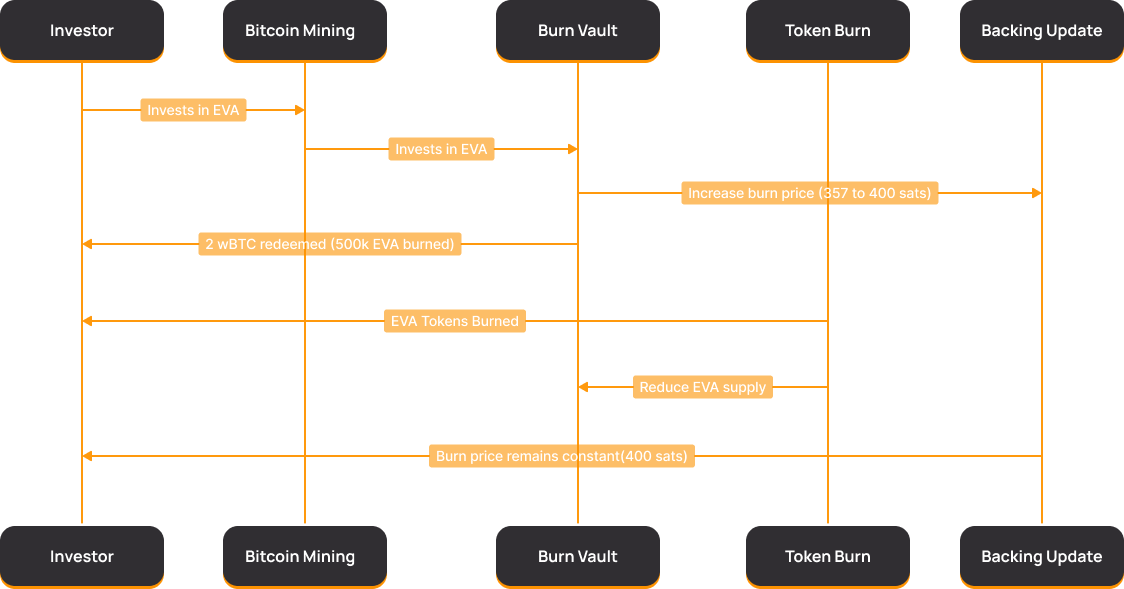

Real-World Example

Consider the following scenario:

Initial State

Total wBTC in Burn Vault: 75 wBTC

Total EVA Supply: 21,000,000

Burn Price: 75 / 21,000,000 = 0.00000357 wBTC (357 satoshis)

Monthly Growth

- Daily BTC mining adds +17 BTC to the Burn Vault per month.

- After one month, the Burn Vault holds 84 wBTC.

New Burn Price:

84 wBTC / 21,000,000 EVA = 0.00000400 wBTC (400 satoshis)

Token Redemption

Suppose an investor burns 500,000 EVA to withdraw 2 wBTC:

- New wBTC in Vault: 82 wBTC

- New EVA Supply: 20,500,000 tokens

Burn Price After Redemption remains the same:

82 wBTC / 20,500,000 EVA = 0.00000400 wBTC (400 satoshis)

Benefits to Investors

Daily Value Appreciation:

- The Burn Price increases daily as mining revenue is added to the Burn Vault.

Guaranteed ROI:

- Investors can calculate when their EVA holdings will surpass their purchase cost.

Deflationary Supply:

- Token burns reduce the total supply, amplifying value for holders.

Key Assumptions:

- No new EVA tokens can be minted.

- wBTC reserves increase daily through mining revenue.

- The only way to withdraw wBTC from the Burn Vault is by burning EVA tokens.

This ensures that the Burn Price can only increase, providing a solid foundation for long-term growth.

Transparency

EVA Protocol emphasizes transparency through:

On-Chain Data:

- All wBTC deposits, token burns, and balances are verifiable in real-time.

Daily Updates:

Note: "With the Burn Vault, EVA guarantees a rising price floor, creating a deflationary ecosystem that rewards long-term holders."

For more details on mining operations or tokenomics, check out our Mining Operations and Tokenomics pages.