About EVA

EverValue Coin (EVA) operates on three core pillars:

Daily BTC Valuation:

- EVA is backed by daily Bitcoin mining, with approximately +17 BTC added to the system monthly.

- Mining rewards are automatically converted to wrapped Bitcoin (wBTC) and stored in a transparent, immutable Burn Vault.

Deflationary Supply:

- EVA tokens have a capped supply of 21,000,000, ensuring scarcity.

- Tokens are burned permanently when redeemed for wBTC, reducing circulation and increasing future payments shares per token.

Price Stability Mechanism:

- EVA's Burn Price (wBTC in burn vault / Total EVA Supply) ensures the token's value can only increase over time.

- This mathematical certainty creates a rising price floor in BTC for all EVA holders.

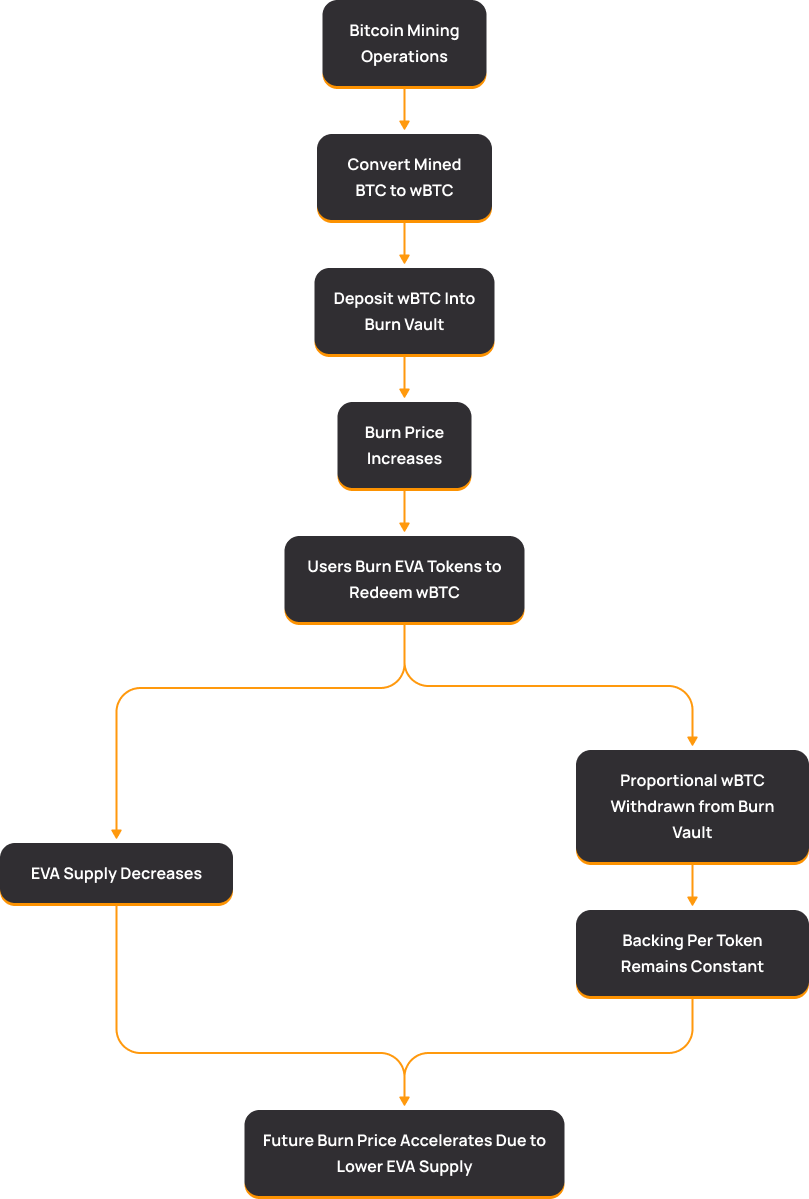

How EVA Works

Depositing wBTC into the Burn Vault

EVA has its own autonomous liquidity system called the Burn Vault. This smart contract, audited by Hacken, stores and receives new Bitcoin deposits daily. As the Burn Vault accumulates wBTC, it increases EVA's liquidity, continually and securely growing its Bitcoin value without requiring any user action. Users only need to hold their EVA tokens in their own wallet.

Depositing wBTC into the Burn Vault

Bitcoins in the Burn Vault come from two main sources: BTC mining and the sale of EVA tokens. The mining hashes are published automatically every day in our application. We convert the mined Bitcoins into wBTC, thus making Bitcoin and mining investments accessible, secure, and fast through DeFi—without imposing unnecessary risks or large initial investments on users.

Token Burning and Supply Reduction:

EVA holders can sell their tokens in our Burn Vault to take profit and withdraw the wBTC that belongs to them, based on the Burn Price. When this happens, the EVA is burned and permanently removed from circulation. This ensures the Burn Price stays the same, because EVA is burned in exact proportion to the wBTC withdrawn by the user, keeping the ratio of wBTC in the Burn Vault to the total supply unchanged.

Anti-Whale Mechanism:

As noted above, no token holder is harmed when an investor sells their tokens in the Burn Vault, even if they hold a large amount ("whale"). On the contrary, reducing the total supply means future BTC deposits are split among fewer tokens, which causes each token's backing—and thus its price in Bitcoin—to rise even more quickly.

Burn Price: The Guaranteed Minimum Price in BTC

The Burn Price is the price in wBTC paid for each EVA when an investor sells their tokens in the Burn Vault. It is mathematically impossible for the Burn Price to decrease, meaning EVA cannot lose value in BTC. On the contrary, EVA is designed to appreciate in BTC every day. That's why we say EVA has a rising price floor in Bitcoin. Understand how the math behind EVA works.

How Fast Does the Burn Price Increase?

This depends on how much BTC is being mined and deposited into the Burn Vault, as well as the number of tokens in circulation. Since the beginning of the project, the Burn Price has increased by 1 to 2 satoshis per day. So, if the Burn Price is at 550 satoshis and the selling price is at 610 satoshis, it means the investor can expect a return on investment within 1 to 2 months. The Burn Price increase is published daily on our Telegram channel.

How Does EVA's ROI Work?

EVA will always be sold in our application at an increasingly higher price in BTC because the Burn Price rises daily. Therefore, if an investor decides to sell their tokens in the Burn Vault shortly after purchasing them, they will incur a loss. However, if they hold their EVA for some time, there will come a point when the Burn Price surpasses the amount in BTC the investor paid for the token. From that point on, the investor can only profit in BTC. This is what we define as ROI.

EVA Price in USD

The percentage of appreciation or depreciation of EVA in USD tends to mirror Bitcoin's performance, as EVA is fully backed by Bitcoin. We often say that if you "opened" an EVA token, you'd find Bitcoin inside it. It's a way to diversify your BTC exposure while making it "yield," as EVA increases in BTC value every day. Additionally, the USD price can fluctuate depending on supply and demand on CEX and DEX platforms, like any project. In this case, ROI depends on market volatility and can even occur immediately after purchase if Bitcoin appreciates.

Value Increasing in BTC

EVA's value in BTC is designed to increase consistently. The token supply cannot grow, while the BTC in the Burn Vault continues to increase daily, creating a rising value floor and offering security to investors.

Investor Benefit

By holding EVA, investors are guaranteed daily and secure appreciation in BTC, taking advantage of the autonomous economic system of the Burn Vault, which protects and increases the token's value over time.

Token Flow Diagram